Cit bank account closed without notice – Citibank account closed without notice? The unexpected closure of a bank account can be jarring, leaving individuals scrambling to understand the reasons and seek recourse. This unsettling experience, unfortunately, affects more people than one might think, raising questions about transparency, customer rights, and the potential for financial distress. This exploration delves into the complexities surrounding such closures, offering guidance and insight for navigating this challenging situation.

We will examine Citibank’s account closure procedures, explore potential legal ramifications of unannounced closures, and Artikel steps customers can take to protect themselves. From understanding legitimate reasons for closure to outlining strategies for preventing future incidents, we aim to provide a comprehensive resource for anyone facing this predicament. The journey towards resolving this issue requires careful investigation, assertive action, and a thorough understanding of consumer rights.

Citibank Account Closed Without Notice: Understanding the Process and Protecting Your Rights: Cit Bank Account Closed Without Notice

Source: v-cdn.net

The unexpected closure of a Citibank account without prior notification can be a distressing experience. This article Artikels the typical account closure procedures, investigates the circumstances surrounding unannounced closures, details customer rights and recourse, and provides strategies for preventing future issues. Understanding these aspects empowers account holders to protect themselves and navigate potential disputes effectively.

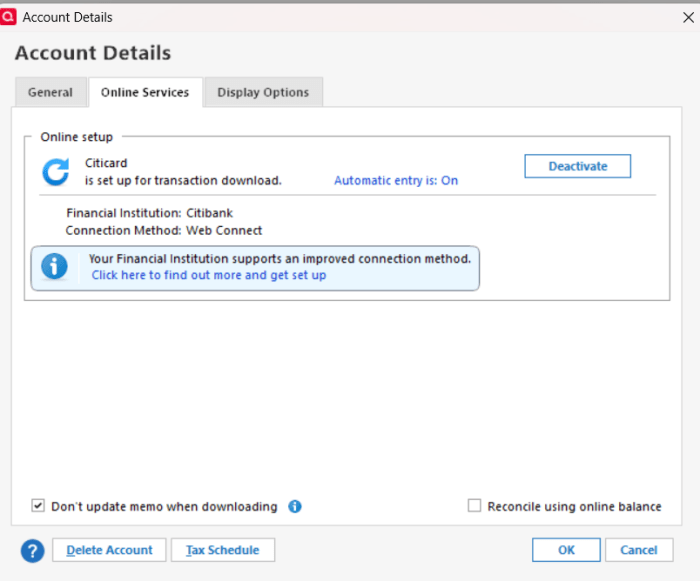

Citibank Account Closure Procedures

Citibank typically follows a defined process when closing a customer’s account. This usually involves communication via email, mail, or phone, providing advance notice before the account is terminated. Legitimate reasons for account closure include suspected fraudulent activity, violation of terms and conditions, prolonged inactivity, or risk assessment related to regulatory compliance. A hypothetical scenario of unannounced closure might involve a technical glitch in the bank’s system, though this is rare and usually rectified quickly.

Another possibility is a misunderstanding regarding account activity triggering automated closure protocols.

Investigating Unannounced Account Closures

Source: cnn.com

Getting your CIT bank account closed without notice? That’s a major bummer, seriously. It makes you wonder about bank practices, especially considering whether other institutions offer better protection. For example, check out if TD Bank uses early warning services, like this resource explains: does td bank use early warning services. Understanding these services might shed light on why your CIT account was closed and help you avoid similar situations in the future.

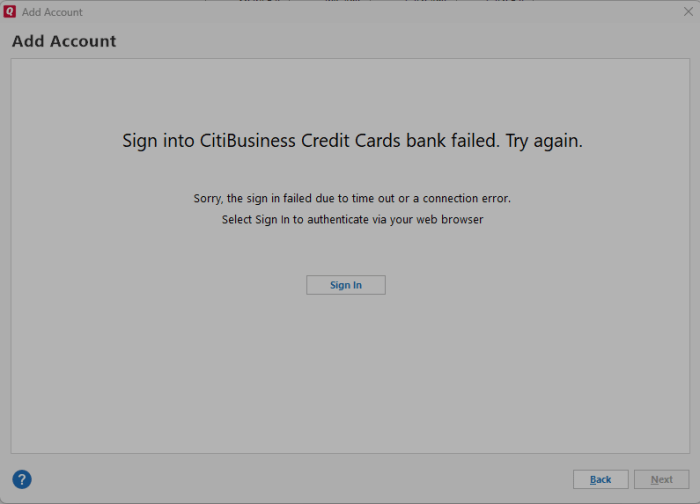

A customer facing an unannounced account closure should follow a systematic approach. This involves gathering documentation, contacting Citibank customer service, and potentially seeking legal counsel if the closure is deemed unjustified.

Below is a flowchart illustrating the recommended steps:

Flowchart: Steps to Take After Unannounced Account Closure

- Gather Documentation: Account statements, emails, and any other relevant communication with Citibank.

- Contact Citibank Customer Service: Attempt to resolve the issue directly with Citibank’s customer support team.

- File a Formal Complaint: If the issue remains unresolved, file a formal complaint with Citibank’s complaints department.

- Seek Legal Advice: If the complaint is not resolved, consult with a lawyer specializing in consumer rights and banking disputes.

- Consider Mediation or Arbitration: Explore alternative dispute resolution methods like mediation or arbitration.

Legally, Citibank could face repercussions for unannounced closures, including legal action from affected customers and potential regulatory fines if the closure violates consumer protection laws. Many customers facing similar situations have reported difficulties in resolving the issue, highlighting the need for clear communication and robust dispute resolution mechanisms from the bank. Red flags indicating a potential closure might include unusual account activity alerts, changes to account terms, or repeated attempts by Citibank to contact the customer regarding suspicious activity.

Customer Rights and Recourse

Customers have several options to dispute an unannounced account closure. These options are Artikeld in the table below:

| Step | Action | Timeline | Outcome |

|---|---|---|---|

| 1 | Contact Citibank Customer Service | Immediately | Resolution or escalation to higher authorities |

| 2 | File a Formal Complaint | Within a specified timeframe (check Citibank’s policies) | Investigation and potential reversal of closure |

| 3 | Seek Legal Advice | If the complaint is unresolved | Legal action, potentially leading to compensation |

| 4 | File a complaint with relevant regulatory bodies | After exhausting internal complaint procedures | Investigation and potential sanctions against Citibank |

Depending on the circumstances, customers might be eligible for compensation or restitution if Citibank acted improperly. Retrieving funds or assets usually involves providing necessary identification and following the bank’s established procedures for closed accounts. Relevant consumer protection laws vary by jurisdiction but often include provisions regarding fair banking practices and dispute resolution.

Preventing Future Account Closures

Maintaining a positive relationship with Citibank involves adhering to account terms and conditions, promptly addressing any discrepancies, and actively monitoring account activity. Proactive measures can significantly reduce the risk of unwarranted account closure.

- Regularly review account statements for any unusual activity.

- Maintain accurate contact information with Citibank.

- Respond promptly to any communication from Citibank regarding account activity.

- Understand and comply with Citibank’s terms and conditions.

- Keep sufficient funds in the account to avoid overdraft fees or insufficient funds issues.

Illustrative Examples and Case Studies, Cit bank account closed without notice

Source: v-cdn.net

Consider a hypothetical scenario where Mr. Smith’s account was closed due to suspected fraudulent activity, although he maintained his innocence. After contacting Citibank and providing evidence to refute the suspicion, his account was reinstated, and he received an apology from the bank.

Timeline of Events:

Day 1: Account unexpectedly closed. Day 3: Contact Citibank customer service. Day 7: Submit supporting documentation. Day 14: Account reinstated. Day 21: Receive apology and explanation from Citibank.

Fictional Account of Unannounced Closure: Ms. Jones discovered her account was closed when attempting an online transaction. She contacted Citibank, initially facing difficulty in getting a clear explanation. After persistent follow-up and providing proof of identity and transaction history, she successfully had her account reopened and received compensation for the inconvenience.

Concluding Remarks

The unexpected closure of a Citibank account, without prior notification, presents a significant challenge for affected customers. However, by understanding Citibank’s processes, recognizing your rights, and taking proactive steps, you can navigate this difficult situation more effectively. Remember, thorough documentation, prompt action, and a clear understanding of consumer protection laws are crucial in resolving this matter and preventing future occurrences.

While the experience can be frustrating, knowledge and preparedness are your strongest allies.